Murky goings on behind the scenes of notorious Canary Islands timeshare giant Anfi Del Mar?

‘River of money’

The ANFI developments which at Baranco de la Verga in Arguineguin, Gran Canaria in 1992, grew into the most successful single-site timeshare sales operation in history. The sales team was 200 strong, and the island’s streets were flooded with hundreds of commission-only touts focussed on persuading tourists to attend presentations at the complexes. Four separate resorts: Anfi Beach Club (ABC), Club Puerto Anfi (CPA) Club Monte Anfi (CMA) and Gran Anfi (GA) and later an additional development a few miles away called Anfi Tauro generated in excess of £100 million per year in revenue between the five resorts.

ANFI maintained this level of success for more than 20 years, signing up an estimated 36,000 members.

Illegal sales practices (on an industrial scale)

In 1999, the law changed to protect victims of high pressure timeshare sales. Among other changes, it became illegal to take any form of payment from a prospect during the Cooling Off period.

Timeshare is an emotional sale that people rarely sign up for if given time to consider the purchase. ANFI, like many other timeshare resorts, chose to take their chances ignoring the new laws rather than risk derailing the gravy train.

Justice finally caught up with the slick money-making machine in 2016. Attempts to sue ANFI by ever increasing numbers of mis-sold clients finally succeeded, when Norwegian Tove Grimsbo was awarded €40,000 in compensation.

Since then, ANFI have had a conservative estimate of £76 million awarded against them by Spanish courts. This number is rising all the time.

Legal investigations

ANFI have faced criminal charges before. In 2021 they were accused of ‘asset diversion’ in a bid to avoid paying their creditors. The case is believed to be ongoing.

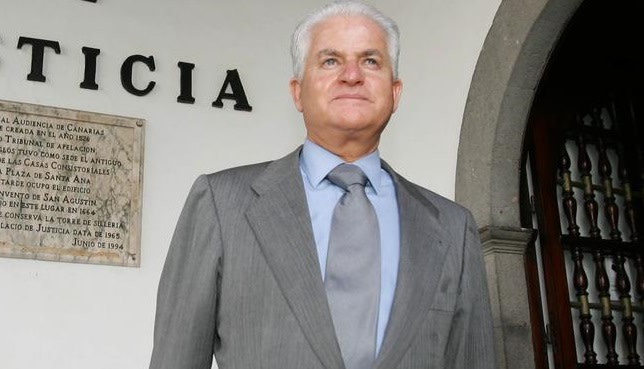

In fresh criminal investigations reported in the Canarian Weekly newspaper in January 2024, one major shareholder, Manuel Santana Cazorla has been accused of selling 50% of his share in the family conglomerate Grupo Santana Cazorla (GSC) to IFA Touristik. The latter is a subsidiary of Lopesan. The deal would mean that Lopesan now owns a 75% stake in ANFI, essentially creating separation between Manuel SC and the tens of millions of pounds worth of liabilities the troubled timeshare operation is struggling with.

The lawsuit being bought by several other members of GSC, accuses that the transaction was conducted by Manuel SC without consulting other GSC partners which would allegedly result in ‘clear harm’ to their interests.

Judge Alberto Puebla is considering indications that lack of transparency may have constituted a crime, ‘potentially leading to legal consequences for those involved.’

What does it mean for ANFI’s creditors?

“Whatever the result of these legal proceedings, we don’t expect it to affect the outcome for creditors, such as the former members who are owed compensation,” explains Suzanne Stojanovic, spokesperson for Timeshare Advice Centre.

“Even if the ownership of ANFI did change, the new owners would own the debts as well. And their vast developments of top class, luxury real estate are clear and visible assets.”

If you own a timeshare and feel you were mis-sold, or no longer feel the product presents value for money, get in touch with our team for free, confidential advice on your options.