Thorough checks and due diligence not enough to protect seasoned real estate guru from losing $24,000 to timeshare resale fraudsters

Offer to buy

53 year old Darren Kittleson owned a timeshare in Mexico’s plush Puerto Vallarta Garza Blanca Preserve Resort & Spa.

Many timeshare owners are looking to get free from their memberships due to the poor value for money and inefficiency of the holiday systems they represent. When real estate veteran Darren got a call from a broker (allegedly representing a company called Westwood Realty) offering to buy his membership at a 70% increase over what he had paid for it, he was keen to accept the deal. “I didn’t really think twice about that price,” the Wisconsin native recounted to the Arizona Republic newspaper.

Not so fast…

A successful 30 year property career makes for a strong measure of cynicism and self preservation.

Kittleson checked everything: He scrutinised Westwood Realty’s company license, listing and address in Arizona. He looked up the real estate licence of the broker which showed a spotless 40 year career in the business.

Everything came back as genuine.

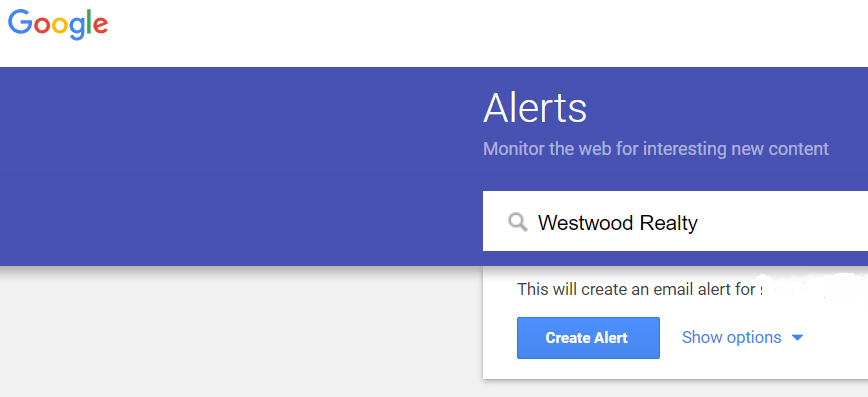

He even placed an alert with Google News for Westwood Realty to let him know if any suspicious activity happened in connection with the firm.

“I thought I was doing everything to verify, verify, verify,” asserts Darren.

So why DID it all check out?

Westwood Realty is a genuine Arizona company. There is a real broker with the (withheld for reputational reasons) name and licence given by the phone caller. Neither party had any inkling that their identities were being used in this manner.

The scammers even used an address in the same building as Westwood Realty for written correspondence.

After Darren Kittleson signed a letter of intent to go ahead with the deal, the offered price appeared to be transferred to him when an email arrived with a genuine looking bank statement which ‘showed’ the funds to have been deposited.

Darren called the bank phone number on the statement and was answered by a Spanish speaking voice confirming the bank name in Mexico.

The money seemed to be on it’s way.

Mechanics of the scam

After a few weeks, the funds hadn’t arrived in his account and Darren was informed this was because he needed to give some tax details and pay a Mexico City law firm to fill in related forms. Said form was delivered, complete with ‘government stamps’ and tax ID. Darren paid the attorney. However the transfer for the purchase price of Darren’s timeshare still failed to materialise.

“I was nervous,” admits Darren. “But I thought: ‘OK this is the first time I have done a property transfer in Mexico.”

Then the scammers told Darren he needed to pay taxes to the state of Jalisco (in Mexico).

An internet search showed this to be normal, and the ‘buyers’ said they would pay this back to Darren. Then they asked him to pay for a series of insurance bonds.

After parting with a total of $24,000, Darren Kittleson acknowledged the fact that he was being defrauded. “At that point I said: ‘I’m done’. It was like ‘Oh I just got scammed,” the businessman told the Arizona Republic newspaper.

Aftermath

Mr Kittleson has made multiple official complaints via the Attorney General, the FBI and the Better Business Bureau but does not believe the fraudsters will ever be caught.

“It is likely they are out of the country,” Darren believes. “And it’s even more likely I won’t see my money again.

“If it sounds too good to be true, it is.”

A Cease and Desist order was filed against the thieves by the Department of Real Estate following these complaints and others from further victims. Although this is probably too late to stop the scammers, who may well be already operating under a different corporate identity.

Expert comment

“Darren Kittleson is probably more savvy than most of us when it comes to avoiding scams,” agrees Andrew Cooper, CEO of European Consumer Claims. “If somebody this experienced can still be caught out by fraudsters, then readers may well be wondering: ‘what possible chance do I have?’

“With the benefit of hindsight, a person in this situation should really look up contact details on the official website and phone the caller back. That would quickly reveal a fraudster. But in this case, and at this stage, money seemed to being given rather than requested.

“In fact, the real clue is in Darren’s own words, warning about a deal that sounds too good to be true.”

“in the timeshare industry, as in broader life, anything that sounds like it has no downside, usually definitely has a hidden downside.

“Timeshare ownerships do not generally have a resale value. It takes powerful, expensive sales and marketing programs to convince people to part with money to buy a membership which is actually a more expensive, less flexible, more difficult way to holiday than using regular booking sites.

“Once the new owner realises this they often look to rid themselves of the membership, but without the benefits of a timeshare marketing and sales budget to help them sell it.

“The resorts also make it very difficult for someone to exit a contract because they rely on the annual fees the member has committed themselves to paying. Therefore, not only do timeshare memberships have no monetary value once bought, normally expert help is necessary to free someone from their contract.

“If stranger called me out of the blue to say that the England football manager was short of players and wanted me to play centre forward on Saturday, I would probably take that with a pinch of salt.

“For the same reason: if someone offers to free you from your membership, give you back all the money you paid for it, and even give you a 70% profit, you can safely assume that person is not telling the truth.”

Realistic advice

If you are a timeshare owner who is no longer happy with their membership, get in touch with our team at ECC.

We can offer you free, expert guidance on your options.